Township of Severn issues 2024 interim tax bills

Tax bill due dates

Interim property tax bills have been issued and reflect 50 per cent of your previous year’s taxes including any adjustment for supplementary taxes.

Interim tax bills are due in two instalments:

- March 8

- May 8

If you haven’t received a tax bill, please contact us and we can help. Property owners are liable for property taxes and late penalties, even if you didn’t receive a tax bill.

If we don't receive your property tax payment by the due date, a late payment penalty of 1.25% will be issued on the day following the due date. An additional 1.25% will be charged each month that your property taxes remain unpaid.

Payment options

Pre-authorized payments |

| Pre-authorized payment plans allow you to set up automatic withdrawals from your bank account every month or on due dates. Sign up for pre-authorized payments at: severn.ca/taxes. |

Cheque |

|

Pay by cheque (to Township of Severn) by mail (PO Box 159, Orillia, Ontario L3V 6J3), in person or by placing the payment in our drop box (1024 Hurlwood Lane, Severn). |

Banking |

| Pay through online or telephone banking, or in person at a financial institution. Please use the 19-digit roll number found on your tax bill (numbers only, no hyphens or spaces) and select Severn Township or Township of Severn as the payee. We recommend doing a keyword search for Severn. |

Where do my tax dollars go?

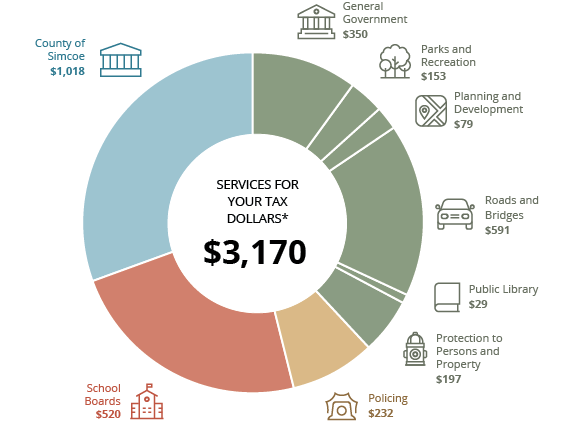

For every dollar that you pay in property taxes, 0.44 cents goes to the Township of Severn. The rest of the money goes to the County of Simcoe (0.32 cents), local school boards (Simcoe Muskoka Catholic District School Board and the Simcoe County District School Board, 0.17 cents) and policing (0.07 cents). We work to ensure that the portion of your taxes that goes to the Township is put toward important services and infrastructure that help keep our residents safe.

Here are some examples:

- parks and recreation

- planning and development

- roads and bridge maintenance

- public library

- protection to persons and property

- general government operations

View our annual Budget and Financial Statements to learn more. The chart below shows the services for tax dollars on an average home in Severn with an assessed value of $340,000*.

Bulletin includes an overview of the 2024 budget

Your tax bill includes a copy of the Severn Bulletin that contains important information for our community, such as:

- summary of the 2024 budget

- tax deadlines and payment options

- reminder to purchase your annual fire permit

- highlights of our online services, such as our online building inspection request form

- details about winter parking restrictions

Stay informed

For further information on municipal services and to stay up to date on new projects and programs, subscribe to our News and Notices.

For more information, visit our website or follow us on Facebook, Twitter, or Instagram.

-30-

Staff contact

Patti Detta

Taxation Officer

Phone: 705-325-2315 x225

Email Patti